Cotisations sociales indépendant - trimestre

Computationquarterly_selfempl_ssc_comp

Description

This description is in

kb/partials/computations/quarterly_selfempl_ssc_comp.html.

The main text describing this computation is Arrêté royal n°38 organisant le statut social des travailleurs indépendants.

Other texts (normally one per year) specify the values of “fractions” used in the computation. See the Fractions section below.

Fractions

We give the values of the “fractions” required for the computation. One set of values are given per year. We include a link to the legislative texts.

| Year | Lex Iterata | Numerator | First denominator | Second denominator |

|---|---|---|---|---|

| 2025 | 2024205904 | 662.28 | 606.3 | 142.75 |

| 2024 | 2023206853 | 656.54 | 553.21 | 142.75 |

| 2023 | 2022043215 | 638.93 | 540.03 | 142.75 |

| 2022 | 2021205999 | 570.76 | 536.06 | 142.75 |

| 2021 | 2020043789 | 546.78 | 528.46 | 142.75 |

| 2020 | 2019205971 | 544.88 | 517.83 | 142.75 |

| 2019 | 2018206297 | 539.18 | 507.05 | 142.75 |

| 2018 | 2017207083 | 527.62 | 497.24 | 142.75 |

| 2017 | 2016206207 | 517.72 | 494.46 | 142.75 |

| 2016 | 2015022570 | 506.6 | 492.78 | 142.75 |

| 2015 | 2014022584 | 501.14 | 487.36 | 142.75 |

| 2014 | 2013022635 | 501.14 | 473.91 | 142.75 |

| 2013 | 2012022487 | 499.59 | 457.73 | 142.75 |

| 2012 | 2012022002 | 490.51 | 447.94 | 142.75 |

| 2011 | 2010022535 | 472.3 | 448.19 | 142.75 |

| 2010 | 2009011599 | 460.41 | 428.9 | 142.75 |

| 2009 | 2008011562 | 460.41 | 421.24 | 142.75 |

| 2008 | 2007023603 | 444.68 | 413.83 | 142.75 |

| 2007 | 2007022087 | 434 | 402.62 | 142.75 |

| 2006 | 2006022043 | 428.31 | 394.36 | 142.75 |

| 2005 | 2004023048 | 414.35 | 388.18 | 142.75 |

| 2004 | 2004022008 | 401.87 | 381.9 | 142.75 |

| 2003 | 2003011031 | 395.5 | 372.69 | 142.75 |

| 2002 | 2002016042 | 388.46 | 363.44 | 142.75 |

| 2001 | 2001016049 | 381.34 | 359.42 | 142.75 |

| 2000 | 2000016057 | 369.13 | 356.02 | 142.75 |

| 1999 | 1998016369 | 363.9 | 350.31 | 142.75 |

| 1998 | 1998016272 | 362.95 | 343.23 | 142.75 |

Management fees 2023

| Social insurance fund | Fees |

|---|---|

| Xerius | 3.05% |

| Acerta | 3.05% |

| GroupS | 3.9% |

| Liantis | 3.95% |

| Avixi | 4% |

| UCM | 4.05% |

| Securex | 4.1% |

| Easypay | 4.2% |

| Partena | 4.25% |

| CNH | 4.25% |

Variables

Inputs

Variables that must be provided by users as inputs to this computation.

This computation doesn't have any user inputs (all inputs are constants).

Constants

Input variables with values defined in legislative texts.

This computation doesn't use any constants.

Intermediates

Output variables used as intermediate results (not presented in documents).

This computation doesn't produce any intermediate outputs.

Outputs

Output variables that are presented in documents.

This computation doesn't produce any final outputs presented in documents.

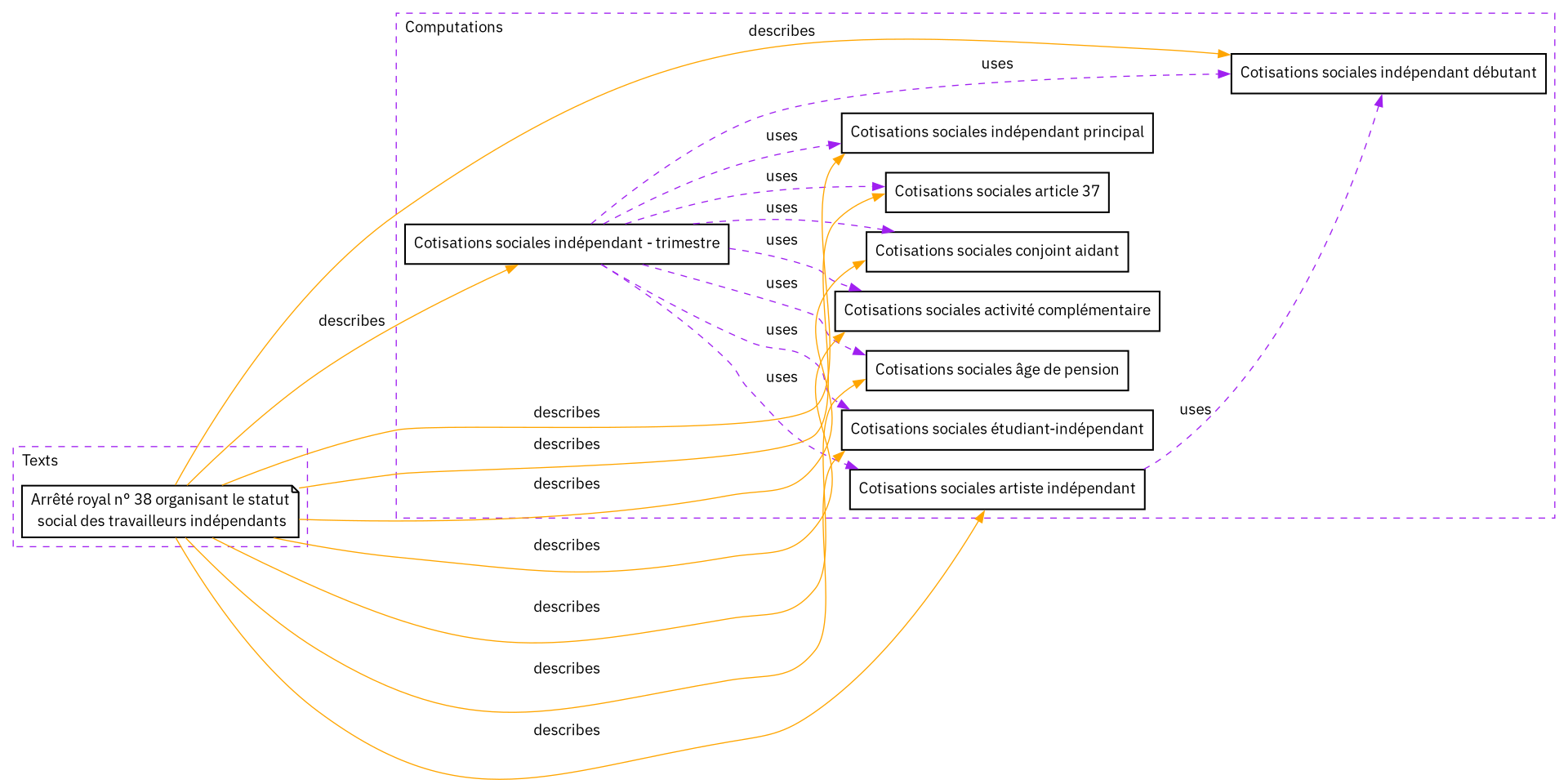

Related computations

Dependencies

Other computations that this computation uses.

- Cotisations sociales article 37 (quarterly_selfempl_ssc_article37_comp)

- Cotisations sociales artiste indépendant (quarterly_selfempl_ssc_artist_comp)

- Cotisations sociales indépendant principal (quarterly_selfempl_ssc_base_comp)

- Cotisations sociales indépendant débutant (quarterly_selfempl_ssc_beginner_comp)

- Cotisations sociales âge de pension (quarterly_selfempl_ssc_pension_age_comp)

- Cotisations sociales activité complémentaire (quarterly_selfempl_ssc_secondary_comp)

- Cotisations sociales conjoint aidant (quarterly_selfempl_ssc_spouse_helper_comp)

- Cotisations sociales étudiant-indépendant (quarterly_selfempl_ssc_student_comp)

Reverse dependencies

Other computations that use this computation.

This computation is not used by any other computations.

Related documents

Documents that present outputs from this computation.

No documents present outputs from this computation.

Related texts

Texts that describe this computation or its variables.

- Texts describing this computation:

- Arrêté royal n° 38 organisant le statut social des travailleurs indépendants (1967072702)